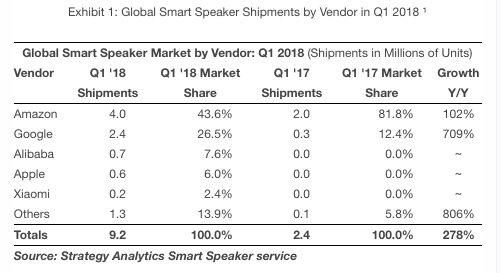

Despite enjoying some early-mover advantage last year, Amazon saw its market share in smart speakers drop to 43.6% in Q1 2018, from a high of 82% in Q1 2017.

This is undoubtedly due to the creeping presence of other competitors in the market, most notably Google, Alibaba and Apple.

Google increased its share of smart speaker shipments from just 12% in Q1 2017 to 26.5% in the same quarter of 2018, shipping a total of 2.4 million Google Home units, up from 300,000 last year.

Analysts expect that Google will continue to gain ground on Amazon and steadily increase their market share. One of the main reasons pinpointed for their success is the fact that Google Assistant is able to operate in 10 languages (with 20 more expected by the end of 2018), while Amazon Alexa trails behind with just 3.

Apple also saw a modest increase after launching the long-awaited HomePod smart speaker in February of this year. They secured a 6% market share and shipped 600,000 units in Q1.

Strategy Analytics’ research on the smart speaker market also revealed that, despite Amazon’s fall in market share, they still managed to ship a whopping 4 million units in Q1 of this year.

If anything, their share adjustment simply underlines the growth of this consumer market and the inevitable push by competitors on Amazon, who enjoyed first mover advantage since launching Amazon Echo back in 2014.

“Amazon and Google accounted for a dominant 70% share of global smart speaker shipments in Q1 2018 although their combined share has fallen from 84% in Q4 2017 and 94% in the year ago quarter,” said David Watkins, director of Strategy Analytics.

“This is partly as a result of strong growth in the Chinese market for smart speakers where both Amazon and Google are currently absent. Alibaba and Xiaomi are leading the way in China and their strength in the domestic market alone is proving enough to propel them into the global top five.”

China is a notoriously difficult market to crack for international manufacturers, as evidenced by the fact that both Google and Amazon have declined to even enter the smart speaker market there.

But that doesn’t mean that Chinese companies are planning to restrict themselves solely to China.

In fact, two weeks ago, Xiaomi announced that it would be bringing its smart home products to the American market and that it would even upgrade them to support Google Assistant. The first products to be introduced in the US will be the Mi Bedside Lamp, Mi LED Smart Bulb and Mi Smart Plug. It remains to be seen if they’ll choose to enter the smart speaker market as well.

David Mercer, vice president of Strategy Analytics, spoke on the future of this growing market: “Further strong growth in smart speaker sales confirms our view that this new market is far more than just a flash in the pan.

“Today’s smart speakers are by no means the finished article but they have captured the consumer imagination and we will see rapid evolution in design, functionality and associated use cases over the coming years. We are clearly heading towards to a time in the not too distant future when voice becomes a standard mode of technology interaction alongside established approaches like keyboard, mouse and touchscreen.”

Who are you betting on in the global smart speaker market?